Table of Content

Questions about how the coronavirus is affecting your finances or our services? You also understand and agree that we are not responsible for any losses or damages if circumstances beyond our control prevent us from making a Bank to Bank Transfer or if the HSBC website was not working properly and you knew about the breakdown when you started the Bank to Bank Transfer. As a condition of using the Service, you warrant to us that you will not use the Service for any purpose that is unlawful or is not permitted, expressly or implicitly, by the terms of this Agreement or by any applicable law or regulation.

In 2006, HSBC announced that it had signed an agreement with Banca Nazionale del Lavoro SpA to acquire the latter's banking operations in Argentina, Banca Nazionale del Lavoro S.A. BNL had started operating in Argentina in 1960 and had 91 branches in 18 provinces, 700,000 active personal customers and 26,700 commercial customers when the HSBC takeover was completed on 28 April 2006. HSBC rebranded the Argentine operations of BNL as "BNL en Argentina es HSBC" , and for two years, maintained the link to BNL, mainly for the community of 70,000 Italian Argentines receiving pensions from Italy. The HSBCnet Mobile app provides a convenient alternative to using your physical Security Device for logging on to HSBCnet.

Ya estoy registrado en HSBC Argentina Mobile Banking

Bank to Bank Transfers allows personal accounts in your name to be added to your profile. Business accounts are not eligible to be used with the Bank to Bank Transfers service. Be sure to check with your financial institution for restrictions regarding transfers among your retirement (401k, etc.), savings, trusts, loans, custodial, and other account types. We are not responsible for any costs or losses incurred from Bank to Bank Transfers that are not permitted under such restrictions by the provider of your Account or those imposed by applicable law. You understand and agree that in the event we are unable to execute your Bank to Bank Transfers request utilizing the ACH, we may utilize other established payment mechanisms in order to complete your funds transfer instructions, such as wire transfer or check. Personal Internet Banking is a service primarily intended for consumer accounts.

In the event of such suspension, you may request reinstatement of your service by contacting us using any of the methods provided for under this Agreement (see “Error Reporting and Claims,” below). We reserve the right in our sole discretion to grant or deny reinstatement of your use of the Service. In the event we agree to reinstate you, we reserve the right to, and ordinarily will, initially reinstate your Service subject to lower per-transaction and monthly dollar limits and/or with other restrictions than otherwise might be available to you. Based upon your subsequent usage of the Service, HSBC in its sole discretion may thereafter restore your ability to effect transfers subject to such higher limits as may then be in effect (see “Dollar Amount of Transfers,” above). You understand that in order to complete Bank to Bank Transfers, it is necessary for HSBC and our service provider to access the websites and databases of your bank and other institutions where you hold Accounts, as designated by you and on your behalf, to retrieve information and effect the fund transfers you request. By using the Service, you represent and warrant to us that you have the right to authorize and permit us to access your Accounts to effect such funds transfers or for any other purpose authorized by this Agreement, and you assure us that by disclosing and authorizing us to use such information you are not violating any third party rights.

International Services

Some online banking services may not be available for certain accounts, customers, or through Mobile Banking. In addition, you agree that we may authorize such financial institutions to charge and debit your accounts based solely on these communications. You agree that your transfer instructions constitute authorization for us to complete the transfer. You represent and warrant to us that you have enough money in the applicable Accounts to make any Bank to Bank Transfer you request that we make on your behalf through the Service. You authorize us to select any means we deem suitable to provide your Bank to Bank Transfer instructions to the applicable financial institution.

You agree not to effect any Bank to Bank Transfers from or to an Account that are not allowed under the rules or regulations applicable to such accounts including, without limitation, rules or regulations designed to prevent the transfer of funds in violation of OFAC regulations. If online banking services weren’t working properly, and you knew about the malfunction when you started the transaction or transfer. HSBC is under no obligation to inform you if it does not complete a transfer or payment because your available balance does not have enough funds to process the transfer or payment.

Card Financial Flexibility

HSBC helps you to understand the new financial world in our financial regulation section. Over the next few years, market infrastructures across the world will align to global ISO standards. We’ve created readiness handbooks to support the transition to ISO 20022, how and why these changes will happen, and the benefits they can bring. RTP® is a registered service mark of The Clearing House Payments Company LLC. Enjoy quick, easy access to your account information from your computer, tablet or smartphone.

Personal Internet Banking services are available 365 days a year and 24 hours a day, except during system maintenance and upgrades. When this occurs, a message will be displayed online when you sign on to Personal Internet Banking. You do not report a lost or stolen Password or PIN within two business days (you may be responsible for up to $500 from date of loss to date of reporting loss).

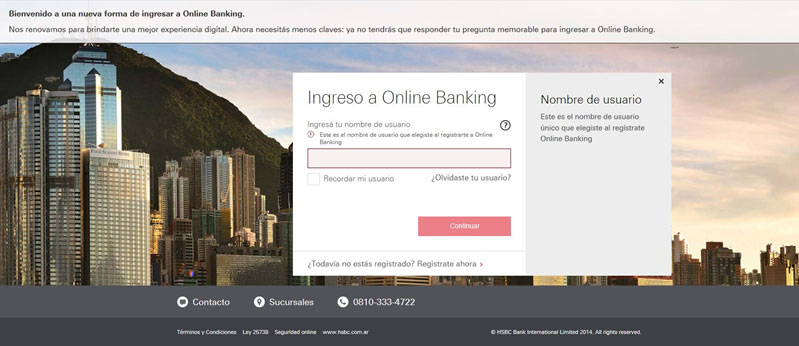

Quiero registrarme a Online Banking

Any transfers or payments you request that exceed the available balance in your account will be treated in accordance with the Rules for Consumer Deposit Accounts, and any other applicable agreements. At our option, we may make a further attempt to issue the payment or process the transfer request. You understand and agree that we may from time to time impose additional charges in connection with your Bank to Bank Transfers transactions. HSBC will notify you of such fee in advance of the transaction and according to applicable rules and regulations. If you choose to proceed with the transaction, you authorize HSBC to debit your account in the amount indicated. We may from time to time make available additional or new features to the Service, including but not limited to, a next day service and a higher limit service.

You shall at all times indemnify, defend and hold HSBC harmless from and against all actions, proceedings, claims or loss, damage, costs and expenses which may be brought against HSBC or incurred by HSBC and which shall have arisen in connection with the instructions transmitted by online banking relating to your business accounts. HSBCnet provides built-in security features permitting you to establish transfer and account access limitations that are not available on Personal Internet Banking. You authorize HSBC to withdraw, debit or charge the necessary funds from your designated account in order to complete all of your designated transfers and payments. You agree that you will instruct us to make a transfer or payment only when there is enough money in your account to cover the transaction at the time of the transfer or payment.

You may not make Bank to Bank Transfers in excess of limits described on the Service. We reserve the right to change from time to time the dollar amount of the Bank to Bank Transfers you are permitted to make using our Service. Without limiting the foregoing, in the event that your use of the Service has been suspended and reinstated as provided herein (see “Suspension and Reinstatement of Bank to Bank Transfers” below), you understand and agree that your use of the Service thereafter may be subject to lower dollar amount limitations than would otherwise be permitted by us. Any customer service communications, including without limitation communications with respect to claims of error or unauthorized use of the Service. Once the test transfer is complete, we may ask you to access your Account to tell us the amount of the test credit or debit or any additional information reported by your bank with this test transfer. We may also verify Accounts by requiring the entry of information you ordinarily use to access the Account provider’s website, or by requiring you to submit proof of ownership of the Account.

1All HSBC Personal Internet Banking clients with an HSBC personal checking, savings, Certificate of Deposit or credit card account are automatically covered. Assumes client follows account safeguarding, personal firewalls and online security diligence practices outlined in HSBC's Security & Fraud Center. As new document types are sent electronically for your eligible accounts, you will automatically receive those new document types electronically instead of by mail without needing to make an additional change in your communication preferences in online banking. At times, we may, in our sole discretion, mail you a paper copy of certain statements and documents even if you have chosen electronic delivery. When a statement or document is delivered electronically, we send an email to alert you that it is available for viewing through online banking.in Personal Internet Banking.

No comments:

Post a Comment